vertiforex.ru Gainers & Losers

Gainers & Losers

2 Months Puppy Food

They need nutrients to build their natural defences and promote good bacteria in their delicate digestive system. Two to four months. The recommended protein range for healthy puppy growth is % on a dry matter basis. These levels support optimal growth, so it is not recommended to exceed. Fidele+ Dry Dog Food Starter Puppy for All Breed Chicken with Natural Ingredients | No Soy | No Wheat | (3 Weeks - 2 Months Puppy Dog) 3 Kg Pack. If you have a small dog breed, start doing the same once it turns weeks old. months: Start feeding your puppy twice every day once it turns Dry food, also known as kibble, is the most common type of food for puppies at 2 months old. It is convenient to store and serve, has a long shelf life, and can. After six months of age, most puppies may be fed twice daily. It is particularly important to offer frequent meals in toy breed puppies. Being so tiny, these. As a general rule of thumb, you should aim to feed a puppy about five to six percent of his or her estimated body weight in adulthood each day. Puppy Age, Number of Meals, Interval between Meals ; Up to 3 months, per day, hours ; months, 3 per day, hours ; months, 2 per day, hours. A 2–3-month-old pup needs about meals daily, usually every five to six hours. Initially, some of these meals may need to be very late at night and early in. They need nutrients to build their natural defences and promote good bacteria in their delicate digestive system. Two to four months. The recommended protein range for healthy puppy growth is % on a dry matter basis. These levels support optimal growth, so it is not recommended to exceed. Fidele+ Dry Dog Food Starter Puppy for All Breed Chicken with Natural Ingredients | No Soy | No Wheat | (3 Weeks - 2 Months Puppy Dog) 3 Kg Pack. If you have a small dog breed, start doing the same once it turns weeks old. months: Start feeding your puppy twice every day once it turns Dry food, also known as kibble, is the most common type of food for puppies at 2 months old. It is convenient to store and serve, has a long shelf life, and can. After six months of age, most puppies may be fed twice daily. It is particularly important to offer frequent meals in toy breed puppies. Being so tiny, these. As a general rule of thumb, you should aim to feed a puppy about five to six percent of his or her estimated body weight in adulthood each day. Puppy Age, Number of Meals, Interval between Meals ; Up to 3 months, per day, hours ; months, 3 per day, hours ; months, 2 per day, hours. A 2–3-month-old pup needs about meals daily, usually every five to six hours. Initially, some of these meals may need to be very late at night and early in.

For ages 6 - 12 months of age, you can begin feeding them twice a day. how many times a day puppies eat infographic. If you choose replacement feeding, feed the amounts listed on the product label. Puppies less than two weeks old should be fed every three to four hours. Once your puppy reaches three months old, you can cut back to two feedings per day and continue that feeding schedule through adulthood. puppy enough food. Make sure you're feeding the right amount. A simple rule of thumb is to feed your puppy 20g per 1kg of body weight per day. So, if you have a puppy weighing 5kg. Homemade puppy food should be nutritionally balanced and veterinarian-approved. Options may include cooked meats (like chicken or turkey). Pedigree PRO Puppy (2 to 9 Months) Small Breed Dry Dog Food, kg, High-Protein Dog Food, Expert Nutrition with 33%* More Nutrients. 4-Week Weaning Guide – When Can Puppies Eat Dry Food Without Water? · Week 1: one part dry dog food, three parts liquid. · Week 2: two parts dry dog food, two. They need nutrients to build their natural defenses and promote good bacteria in their delicate digestive system. Two to four months. Large breed puppies mature more slowly, so you might need to keep them on puppy food until they're 13 or 14 months old. Your vet can help you to decide when. During lactation, feed as much as she wants (usually two to five times the guideline amount, depending on litter size). Because IAMS Puppy food is complete. Dogs should eat food specially formulated for puppies' developmental needs until they stop growing, which usually takes between 10 and 18 months depending on. Younger puppies (especially small breeds) between four and six months old, should eat three to four times a day. Once they're six months, you can move to two. Puppies are largely carnivores but will also eat some plant-based foods. Puppies naturally wean off their mother's milk at around weeks of age. Wild dogs. Small & Medium Breed Puppy ; Riboflavin B-2, mg/kg ; Thiamine B-1, mg/kg ; Linolenic Acid, % ; Carbohydrates, % ; Ounces per cup, oz. Why do the feeding guidelines in IAMS Puppy food decrease so much around 6 months of age? During the first 6 months of a puppies life growth they grow very. Tips on how to feed your puppy from months #dogfeeding #puppyfeedingtime #puppydog #feedingtip #dogfeedingvideo #rottweilerfeeding · 2 Months. Puppies should be eating food nutritionally designed to meet their needs for bone and muscle growth, like Hill's® Science Diet® Puppy foods, which fuels your on. Puppy Feeding Chart1 · Up to 3 months: ½ to 1¼ cups · 4 to 5 months: 1⅛ to 2 cups · 6 to 8 months: ¾ to 1⅓ cups · 9 to 11 months: 1 to 1½ cups · 1 to 2 years: Feed. The frequency of feeding puppies goes down to 3 times per day at around 3 to 6 months of age, and 2 times per day at around 6 to 12 months. After about a year. Large breed puppies usually need puppy food between months of age depending on their expected weight and breed. Conclusion. As a general rule, puppies can.

Citi Concierge Service

Appreciate any sharing about restrictions or challenges you encountered with the concierge service. Thanks in advance! Upvote 2. Downvote 7. Customer service is the worst concierge I have ever dealt with,holding high end cards for over 20 years. Hard to get a hold of and certainly not there to. With Citi Concierge, you have access to a staff of experts working around the clock to help you get things done and save time. It's an easy and convenient. bell. Save time and get more done with Citi® Concierge service. miles. Earn 1 mile for every $1 spent on purchases. No limit to the number of miles you. For further details on the suite of Citi Prestige Concierge Services, you may contact the Citi Prestige Service hotline at +00 , 24 hours a day, 7 days. Citi Concierge Banker interview questions and 11 interview reviews Customer Service - Starting at $19/hr - Roy UT. Citi - Roy, UT. $ Per. Mastercard Travel & Lifestyle Services for Citigold Private Clients. A world of experiences is waiting for you. Log in or register to connect to. The offer you have selected is being refreshed. Please select a category to discover other great deals for your Citi card. The complimentary Citigold Concierge service helps clients book reservations, tickets and vacations. Are there Monthly Service Fees and Non-Citi ATM fees in. Appreciate any sharing about restrictions or challenges you encountered with the concierge service. Thanks in advance! Upvote 2. Downvote 7. Customer service is the worst concierge I have ever dealt with,holding high end cards for over 20 years. Hard to get a hold of and certainly not there to. With Citi Concierge, you have access to a staff of experts working around the clock to help you get things done and save time. It's an easy and convenient. bell. Save time and get more done with Citi® Concierge service. miles. Earn 1 mile for every $1 spent on purchases. No limit to the number of miles you. For further details on the suite of Citi Prestige Concierge Services, you may contact the Citi Prestige Service hotline at +00 , 24 hours a day, 7 days. Citi Concierge Banker interview questions and 11 interview reviews Customer Service - Starting at $19/hr - Roy UT. Citi - Roy, UT. $ Per. Mastercard Travel & Lifestyle Services for Citigold Private Clients. A world of experiences is waiting for you. Log in or register to connect to. The offer you have selected is being refreshed. Please select a category to discover other great deals for your Citi card. The complimentary Citigold Concierge service helps clients book reservations, tickets and vacations. Are there Monthly Service Fees and Non-Citi ATM fees in.

Call Your Citi Health Concierge · Aetna: 1 () · Anthem: 1 () CONCIERGE SERVICES Aspire to Engage. Aspire Lifestyles is a Concierge industry pioneer with nearly 30 years of experience designing and managing high-. Read what Concierge Banker employee has to say about working at Citi: Just speaking from my area and personal experience. Customer Service Representative. The estimated total pay range for a Concierge at Citi is $40K–$59K per year, which includes base salary and additional pay. The complimentary Citigold Concierge service helps clients book reservations, tickets and vacations. Email your Citigold Concierge: goldconcierge@. “Travel Services” includes all benefits provided under Mastercard World. Elite platform. “US” means United States. 2. CITI PRESTIGE CONCIERGE SERVICES. Our concierge service offers a wide range of health and wellness benefits, including in-home healthcare provider (MD or NP) visits, teeth cleanings, vaccines. Concierge Services. Citigroup Centre has been designed to inspire both those who visit and those who work within the building. An array of premium services and. It also provides concierge service and access to Priority Pass airport lounges. . Citi Prestige Credit Card vs. Chase Sapphire Preferred Card. Annual Fee: The. Concierge. Get assistance with travel planning, entertainment tickets and With the Visa Lost/Stolen Card Reporting service, reporting a lost or stolen card is. Your Citi Health Concierge team may be reaching out to you through text. Our text phone number is , label it Citi Concierge so you know it's us, it's okay. Contact us at [email protected] or (TTY: We accept or other Relay Service). Shop with Citi and PayPal. Shop with Citi and. 37 votes, 29 comments. Many premium grade credit cards (Amex Plat, Citi Ritz, etc) come with a concierge service as a benefit. Define Citi ULTIMA Concierge Services. means the concierge services offered to Citi ULTIMA Cardmembers by Citibank in accordance with these Terms and. Be sure to stop by the Citi Perks Concierge located at the top of the Jackie Robinson Rotunda to learn about Citi offerings, answer your questions, and much. % Concierge Services is a complimentary service available to the Primary Cardholder. Refer to the Terms and Conditions of the Citi Rewards Program. For Citi. Nature of business (SIC). - Other information service activities not elsewhere classified; - Activities of other holding companies not elsewhere. Read what Concierge Banker employee has to say about working at Citi: Just speaking from my area and personal experience. Citibank can be an amazing career. concierge service (Amex & Citi). (-) versions are the lowest (MaterCard). The reality on this particular benefit is that the service levels are relatively. Mastercard Golf. Get exclusive PGA TOUR® experiences and access amazing golf benefits with our Golf Concierge Service.

Smart Ways To Save Money Fast

Tips for Saving Money · 1. Manage Your Spending · 2. Consider Cash Back · 3. Focus on Major Expenses · 4. Don't Go Overboard. Here are some tricks to grow savings quickly: 1. Create a shopping list to tame impulse buys: 84 % of the customers make impulse purchases. 1. An emergency fund is a must. · 2. Establish your budget. · 3. Budget with cash and envelopes. · 4. Don't just save money, save for your future. · 5. Save. Nine smart ways to save money · Set savings goals · Make savings automatic · Save the change · Pay bills on time · Avoid impulse buying · Combine debt · Cancel. Saving money by making lifestyle changes · 1. Shop at cheaper supermarkets · 2. Make sensible swaps · 3. Get rewarded for shopping · 4. Combat world waste & eat. Automating payments for bills takes just a few minutes and it's another great way to save money. Often bills that are paid early come with discounts, which. Set a budget so you understand your savings capacity. · Cutting out unnecessary expenses in the short term can improve your cash flow and therefore give you more. 10 Money Saving Tips · 1. Track your spending. · 2. Establish a budget. · 3. Set up savings goals. · 4. Use an automated tool. · 5. Prepare for grocery shopping in. Simple ways to save money · Separate and automate your savings · Look for ways to reduce spending · Have a savings plan · Set a savings goal · Pay off some debt · Up. Tips for Saving Money · 1. Manage Your Spending · 2. Consider Cash Back · 3. Focus on Major Expenses · 4. Don't Go Overboard. Here are some tricks to grow savings quickly: 1. Create a shopping list to tame impulse buys: 84 % of the customers make impulse purchases. 1. An emergency fund is a must. · 2. Establish your budget. · 3. Budget with cash and envelopes. · 4. Don't just save money, save for your future. · 5. Save. Nine smart ways to save money · Set savings goals · Make savings automatic · Save the change · Pay bills on time · Avoid impulse buying · Combine debt · Cancel. Saving money by making lifestyle changes · 1. Shop at cheaper supermarkets · 2. Make sensible swaps · 3. Get rewarded for shopping · 4. Combat world waste & eat. Automating payments for bills takes just a few minutes and it's another great way to save money. Often bills that are paid early come with discounts, which. Set a budget so you understand your savings capacity. · Cutting out unnecessary expenses in the short term can improve your cash flow and therefore give you more. 10 Money Saving Tips · 1. Track your spending. · 2. Establish a budget. · 3. Set up savings goals. · 4. Use an automated tool. · 5. Prepare for grocery shopping in. Simple ways to save money · Separate and automate your savings · Look for ways to reduce spending · Have a savings plan · Set a savings goal · Pay off some debt · Up.

Start by saving $1 every day · Set up automatic savings · Use direct deposit · Save extra money when you can · Commit to daily savings · Build an emergency fund. Understand Spending Habits Before you can save, you need to understand where your money goes. The best way to do this is to track your expenses for a month. Set specific, realistic savings goals, and plan to hit them by cutting costs or increasing your income. Sometimes it can be hard to figure out the best way to. What Is The Best Way To Reduce Costs With A Low Income? · 1. Make A Budget Plan · 2. Track Your Spending · 3. Shop Smart · 4. Limit Eating Out · 5. Cut Back on. 1. Eliminate Your Debt · 2. Set Savings Goals · 3. Pay Yourself First · 4. Stop Smoking · 5. Take a Staycation · 6. Spend to Save · 7. Utility Savings · 8. Pack Your. Stop smoking. Quitting smoking isn't just good for your health; it'll make your pocket feel a whole lot better too, as you'll save on. The best way to bring discipline in your savings habit is to open a separate account for your savings, apart from your regular salary or business account. If you're able to leave the money in for longer periods of time, you could consider stashing cash in a certificate of deposit (CD), which pays a fixed interest. 11 Great Money Saving Tips · 1. Switch your bank account. · 2. Save loose change. · 3. Create a budget. · 4. Making a shopping list and stick to it. · 5. Avoid. 10 Smart ways to Start Saving Money · i. Choose a bank that gives back and gives back plenty: · ii. Ideal distribution of your salary: · iii. Set targets with a. How to Save Money Fast · 1. Cut Unnecessary Expenses · 2. Increase Income · 3. Implement Smart Saving Strategies. Make it as hands-off as possible. Look at your budget every few months. After necessary expenses, how much money are you looking at? Pay. If you're just beginning to put money away for retirement, start saving as much as you can now. That way you let compound interest — the ability of your assets. The most fundamental rule in saving money is to spend less than you make. Crafting a budget to track where your money is going is a great place to start. 10 Money Saving Tips · 1. Track your spending. · 2. Establish a budget. · 3. Set up savings goals. · 4. Use an automated tool. · 5. Prepare for grocery shopping in. Saving automatically is one of the easiest ways to make your savings consistent so you start to see it build over time. One common way to do this is to set up. Use coupons at the store. There's no need to go old school and cut out coupons from the paper anymore. Download some apps that make couponing fast and easy. 10 STEADY Ways I Save Money As a Single Person-Frugal Living · 10 Smart BACK TO SCHOOL Shopping Tips: How To SAVE Money on a Tight Budget in · 5 Things I. Consider using a basic savings or money market account. · Look for an account that pays you back. · Save enough to cover three to six months of expenses. · Start. Seven more tips to make the money you save go even further · 1. Pay down high-interest debt · 2. Automate your savings · 3. Max out your employer's (k) match · 4.

0 Balance Transfer And No Fee

Save up to hundreds of dollars a year on interest. Get introductory low interest rate on balance transfers for first 6 months with Scotiabank Value Visa. Balance transfer fees may apply. A balance transfer can give you the flexibility to: Pay off high-interest balances; Fund large expenses, such as home. Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within 90 days of account opening. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. No Fees; I don't mind. Special Offers; See my cards. CashSurge After all, some balance transfer credit cards have introductory interest rates as low as 0%. Wells Fargo has a zero percent interest card for 21 months but it comes with a 3 percent fee. This card is the best option since you will have. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. With no fee to transfer your balance and 0% interest on balance transfers for 12 months, our card is ideal for those wanting to keep costs low. Save up to hundreds of dollars a year on interest. Get introductory low interest rate on balance transfers for first 6 months with Scotiabank Value Visa. Balance transfer fees may apply. A balance transfer can give you the flexibility to: Pay off high-interest balances; Fund large expenses, such as home. Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within 90 days of account opening. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. No Fees; I don't mind. Special Offers; See my cards. CashSurge After all, some balance transfer credit cards have introductory interest rates as low as 0%. Wells Fargo has a zero percent interest card for 21 months but it comes with a 3 percent fee. This card is the best option since you will have. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form. With no fee to transfer your balance and 0% interest on balance transfers for 12 months, our card is ideal for those wanting to keep costs low.

Balance transfers must be completed within 4 months of account opening. There is a balance transfer fee of either $5 or 5% of the amount of each transfer. Balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater. Low intro APRon purchases for 12 months. 0% Intro APR for. We never charge a balance transfer fee (or annual fee or cash advance fee). It's a totally free service to you! Credit-Cards-Icon. The MBNA True Line® Mastercard® offers the most sought-after combination of features in a balance transfer. Get a 0% promotional annual interest rate (“AIR”)†. To get the 0% and fee, you usually have to transfer within the first one to three months. You could get a 0% promotional annual interest rate (“AIR”)† for 12 months on balance transfers✪ completed within 90 days. You'll pay no balance transfer fee and no cash advance fee. There's no penalty interest rate in the fine print, and no annual fee for the Visa Value credit. Transfer your credit card balance — get 0% interest for up to 10 months with a 1% transfer fee and a first year annual fee rebate. To get the 0% and fee, you usually have to transfer within the first one to three months. A one-time balance transfer fee like this could end up costing you more than a low APR with no fees. Some financial institutions, like Navy Federal Credit Union. 0% for the first 13 months and no fee for balance transfers. Representative APR (variable). Available to UK residents, aged 18+ and earning at least £10K. ESL Visa® Credit Card. The best credit card with no balance transfer fee is the ESL Visa® Credit Card because it gives you a year to pay off your balance. Choose from Prospera credit cards offering cash back, travel rewards, low rates, no US foreign transaction fees, trip insurance, and no-frills convenience. A balance transfer APR applies only to eligible balance transfers and is generally 0% for a set time period. It will then increase to a standard APR. Balance. Take control of your finances and enjoy 0% interest on balance transfer fees with our Everyday Credit Card. No annual fee. Welcome offer. Rewards Cash back. Next. Filters. Credit range 0% on balance transfers for 15 months. APR. % - With 0% Intro APR on balance transfers for the first 18 billing cycles, thereafter a variable APR of %, %, or %, and no annual fee. The good news is there are some lenders, such as TwinStar Credit Union, that have zero percent balance transfer fees. Also, when using no balance transfer fee. Pay 0% on interest for the first 9 months* when you transfer your existing credit card balances to a 1st Choice Savings credit card for a low, one-time transfer. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs.

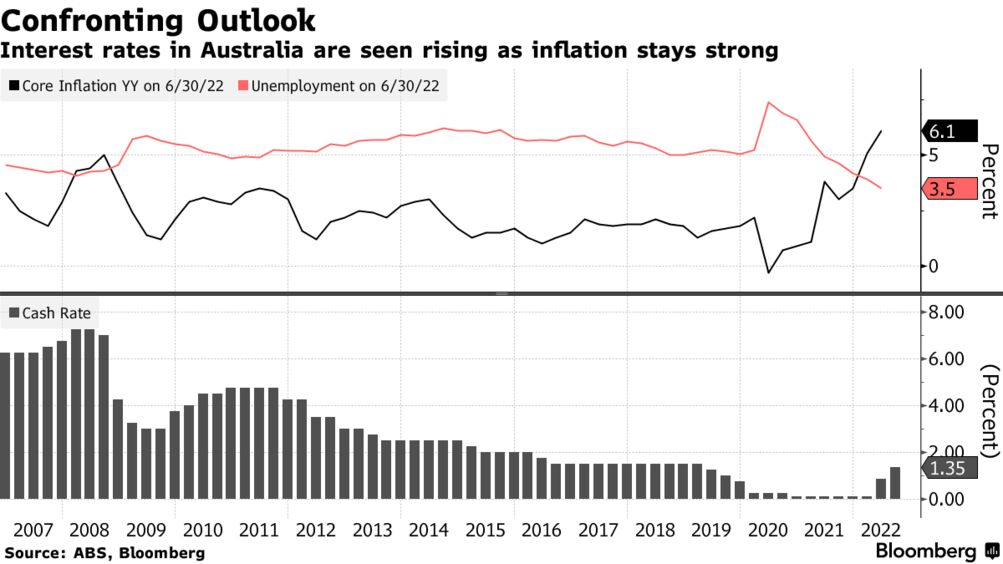

Best Interest Rates Australia

Mozo helps you to compare high interest savings rates from over 60 Australian banks and savings providers SAVINGS ACCOUNTS. Australia's Best Savings. CommBank Neo interest-free credit card with one simple monthly fee - no late fees or international transaction fees; Everyday Account Smart Access has no. The best interest rate listed on Canstar's database for a savings account is %, but that's just a four-month introductory rate. Get greater returns and reach your savings goals with competitive savings account interest rates We're one of Australia's biggest banks, and we're also the. Interest rates ; Stepped interest is payable on deposits in Macquarie Business Savings Accounts based on your balance as follows: ; Rate, Balance ; % p.a., Up. Do your thing with our great range of savings products with no fees! Check Products are issued by ING, a business name of ING Bank (Australia) Limited ABN Highest 5-year term deposit rates ; Judo Bank go-to-site, % ; Rabobank Australia, % ; Bank of Melbourne, % ; BankSA, %. Find the best savings account in Australia ; Macquarie Savings Account. Macquarie Bank logo. Finder score. Great. Maximum Variable Rate p.a.. % ; Bank of. A competitive savings account will offer an interest rate of around 4% to 5% or more. A transaction account will usually have an interest rate between 0% and 1. Mozo helps you to compare high interest savings rates from over 60 Australian banks and savings providers SAVINGS ACCOUNTS. Australia's Best Savings. CommBank Neo interest-free credit card with one simple monthly fee - no late fees or international transaction fees; Everyday Account Smart Access has no. The best interest rate listed on Canstar's database for a savings account is %, but that's just a four-month introductory rate. Get greater returns and reach your savings goals with competitive savings account interest rates We're one of Australia's biggest banks, and we're also the. Interest rates ; Stepped interest is payable on deposits in Macquarie Business Savings Accounts based on your balance as follows: ; Rate, Balance ; % p.a., Up. Do your thing with our great range of savings products with no fees! Check Products are issued by ING, a business name of ING Bank (Australia) Limited ABN Highest 5-year term deposit rates ; Judo Bank go-to-site, % ; Rabobank Australia, % ; Bank of Melbourne, % ; BankSA, %. Find the best savings account in Australia ; Macquarie Savings Account. Macquarie Bank logo. Finder score. Great. Maximum Variable Rate p.a.. % ; Bank of. A competitive savings account will offer an interest rate of around 4% to 5% or more. A transaction account will usually have an interest rate between 0% and 1.

Savings and Transactional Accounts interest rates. ; Community Reward Account · $0 - $4,, % p.a.. $5, - $,, % p.a.. $,plus ; monEsaver. Interest rate % p.a.. Calculated daily, paid monthly. Fair-go banking for those under Our Life Saver is the account that grows. Back to top We pay our respect to First Nations peoples and their Elders, past and present. © Commonwealth Bank of Australia ABN 48 AFSL and. High variable interest rate. Eligible customers could get a great variable rate of % p.a. · No ING fees. With zero ING fees, all your money gets put to good. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Want to ensure your savings account has the best interest rate? Compare and If you are 55 years or older and retired, or receive an Australian government. Interest Rates for Savings Accounts ; Growth Saver Rates · *With Bonus · % p.a. ; Everyday Options Sub-account · Annual Interest Rate · % p.a. ; Carbon. Unity Bank MoneyMax - currently %pa · ANZ Save - %pa · CBA GoalSaver - %pa · Macquarie Savings - % pa (%pa for first 4 months). Top. Our savings account rates. Easy Saver Bankwest is a division of Commonwealth Bank of Australia, which is the product issuer unless otherwise stated. Interest Rate ; Singapore, , ; Euro Area, , ; Canada, , ; Australia, , Find the best mortgage rate whether you're buying your first home, upgrading, investing, or refinancing. Compare home loans from 39 Australian lenders. What's new in savings accounts in September ? ; ING Savings Maximiser, %, $, ; uBank Save, %, $, ; MOVE Bank Growth Saver, %, $25, All Investor Fixed Rate home loans revert to the Investor Basic Variable Principal & Interest Reference Rate (currently %) at the expiry of the fixed term. HISA intro variable rates ; Interest rate (% p.a.) ; 4 month additional variable rate. % ; Standard variable rate. % ; Total intro rate. %. % 2 p.a.. Interest earned when you meet the monthly criteria. Top up your savings with Round Ups. Comes linked with. Current rates can be viewed by visiting vertiforex.ru Monthly Bonus rate applies for the month the eligibility criteria is met, calculated from. %. current official cash rate determined by the Reserve Bank of Australia (RBA). The RBA held the cash rate in. Our Save account comes with great rates and savings tools to help you get ahead Products issued by ubank, part of National Australia Bank Limited ABN. Bank account interest rates ; Account Balance between $, to $, % p.a.. % p.a. ; Account Balance between $, to $, %. Includes the Fixed Rate Special Offer2 Term Deposit of % p.a. for Terms of months and an additional % p.a. online bonus offer3 when you open.

Etf Of Cryptocurrencies

After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. Bitcoin ETFs, or Exchange Traded Funds, are financial products that track the price of Bitcoin. They allow investors to gain exposure to the cryptocurrency. A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts. Invesco's spot bitcoin and Ethereum ETFs grew out of our strategic partnership with Galaxy, a leading financial services innovator in the digital asset sector. The introduction of Bitcoin and Ethereum Futures ETFs has had several implications in the cryptocurrency market. These ETFs provide a more accessible and. Bitcoin ETFs are exchange-traded funds that track the value of Bitcoin and trade on traditional market exchanges rather than cryptocurrency. Buy and sell crypto like bitcoin and ethereum, starting with as little as $1. Trade crypto 7 days a week—23 hours a day—on our website and mobile app. They are funds that invest in futures and options pegged to the performance of Bitcoin, Ether and other cryptocurrencies, or in cryptocurrency investment. Learn more about Crypto ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. Bitcoin ETFs, or Exchange Traded Funds, are financial products that track the price of Bitcoin. They allow investors to gain exposure to the cryptocurrency. A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts. Invesco's spot bitcoin and Ethereum ETFs grew out of our strategic partnership with Galaxy, a leading financial services innovator in the digital asset sector. The introduction of Bitcoin and Ethereum Futures ETFs has had several implications in the cryptocurrency market. These ETFs provide a more accessible and. Bitcoin ETFs are exchange-traded funds that track the value of Bitcoin and trade on traditional market exchanges rather than cryptocurrency. Buy and sell crypto like bitcoin and ethereum, starting with as little as $1. Trade crypto 7 days a week—23 hours a day—on our website and mobile app. They are funds that invest in futures and options pegged to the performance of Bitcoin, Ether and other cryptocurrencies, or in cryptocurrency investment. Learn more about Crypto ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news.

Crypto ETFs can be a convenient way to invest in Cryptocurrency through your regular brokerage account, without the hassle of direct crypto ownership or. HODL - Overview, Holdings, & Performance. VanEck's new Bitcoin ETF offers investors the option to trade Bitcoin with no direct holding needed. A crypto ETF enables traders and investors to trade the underlying cryptocurrency on the U.S. stock exchanges. A crypto ETF aims to mirror the price movement of. Evolve Bitcoin ETF (TSX: EBIT) provides investors with a simple and efficient means for investing in a cryptocurrency such as bitcoin. Cryptocurrency exchange-traded funds (ETFs) track the price performance of cryptocurrencies by investing in a portfolio linked to their instruments. In order for an ETF to become available to investors, it must be approved by the Securities and Exchange Commission (SEC) and registered under the Investment. The Hashdex Nasdaq Bitcoin Reference Price ETF has been structured to be carbon-neutral – the investment manager will purchase carbon credits and invest in. ProShares Bitcoin Strategy ETF (BITO) is the first U.S. bitcoin-linked ETF offering investors an opportunity to gain exposure to bitcoin returns in a. Fund details, performance, holdings, distributions and related documents for Schwab Crypto Thematic ETF (STCE) | The fund's goal is to track as closely as. Introducing IBIT – the iShares Bitcoin Trust ETF, an exchange-traded product that provides convenient exposure to Bitcoin. Below, we discuss the pros and cons of crypto ETFs, the different strategies each type of crypto aligns with, and their potential rewards and pitfalls. A cryptocurrency ETF is an exchange-traded fund that tracks the price of a single cryptocurrency or a basket of cryptocurrencies. Some crypto funds track the. The iShares Blockchain and Tech ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies that are involved in the. Invesco's exchange-traded funds (ETFs) give investors access to digital assets, including cryptocurrencies like bitcoin and blockchains like Ethereum. Exchange-traded funds — better known as an ETFs — are similar in many ways to mutual funds. They generally track the price of an asset (like gold) or basket of. Ether will be the second cryptocurrency approved for spot ETFs after regulators cleared ETFs linked to spot bitcoin in January. With that policy change, the SEC. The world's first Bitcoin ETF. Own a piece of history with the first physically settled Bitcoin ETF available to investors. Understanding Bitcoin Exchange Traded Funds (ETFs): Opportunities and Caveats. Explore investments linked to the world's largest cryptocurrencies, offering a convenient and transparent way to invest in Bitcoin and Ether linked. It's possible to purchase ETFs that track the two biggest cryptocurrencies 2, Bitcoin and Ethereum, or a combination of the two.

Housing Loan Amortization

A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. The income required for your desired loan amount is approximately: Other indicative figures: Principal & Interest: Insurance: Monthly Amortization. What is amortization? Amortization is the process of paying off a debt with a known repayment term in regular installments over time. What is a Home Loan EMI? Home Loan EMI, or Equated Monthly Instalment, is a systematic approach to repaying your Home Loan in uniform amounts per month. Loan Calculators. Couple signing papers. Take the guesswork out of managing and repaying loans. By understanding the numbers from the start, you can ensure. Amortization is the process of paying for a loan by making a series of fixed payments each month (or other agreed upon periods) until your balance reaches zero. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly. Use our Loan Amortization calculator to calculate the amount you need to pay per month based on the Loan Amount, Annual Interest Rate, Total Period and Cushion. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. The income required for your desired loan amount is approximately: Other indicative figures: Principal & Interest: Insurance: Monthly Amortization. What is amortization? Amortization is the process of paying off a debt with a known repayment term in regular installments over time. What is a Home Loan EMI? Home Loan EMI, or Equated Monthly Instalment, is a systematic approach to repaying your Home Loan in uniform amounts per month. Loan Calculators. Couple signing papers. Take the guesswork out of managing and repaying loans. By understanding the numbers from the start, you can ensure. Amortization is the process of paying for a loan by making a series of fixed payments each month (or other agreed upon periods) until your balance reaches zero. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or monthly. Use our Loan Amortization calculator to calculate the amount you need to pay per month based on the Loan Amount, Annual Interest Rate, Total Period and Cushion. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount.

The Full Monthly Repayment Chart and Understanding Your Payment Allocations. No one factor affects the cost of purchasing a house more than length of the loan. We take your inputs for home price, mortgage rate, loan term and *This table depicts loan amortization for a $, fixed-rate, year mortgage. a home appraisal in order to get a home loan? How long does the whole loan process take? See all home mortgage FAQs >. Resources and tools. Mortgage rates. Have you found a home? Start your application process. Start your application. Reach out to an experienced loan officer. Find a mortgage loan officer. What is. An amortized loan has a payment made up of principal – the amount you borrowed, or your loan balance – and the interest you pay for borrowing the money. The mortgage amortization calculator can display the composition of your loan's Housing Opportunity. © JPMorgan Chase & Co. Start of overlay. Chase. The number of years and months over which you will repay this loan. The most common amortization period is 25 years. Not to be confused with the term of your. Get the Home Loan Repayment Amortization Schedule monthwise for free. Find out your monthly EMI, Interest, Prinical and the monthly loan amount outstanding. Home Loan amortization refers to the breakup of interest and principal components in each EMI. For any term loan, the interest component remains the highest in. Use our Home Loan Calculator to get insights on your loan plan! Just select an amount, set an approximate interest rate and loan tenure. The Home Loan EMI. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component. HDFC Bank's EMI calculators give a. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component. HDFC Bank's EMI calculators give a. & more. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization Mortgage Research Center, NMLS #, Equal Housing. Our Amortisation Schedule Calculator helps you break down your total loan amount into Interest Paid, Principal Paid and Balance Due over the course of your. Get the Home Loan Repayment Amortization Schedule monthwise for free. Find out your monthly EMI, Interest, Prinical and the monthly loan amount outstanding. What is the meaning of a Home Loan Amortization Schedule? The amortization schedule is a periodic table that offers a complete breakage of the housing loan EMI. Mortgage Amortization Calculator. Create a home loan amortization schedule and calculate payments. Use this home loan calculator to generate an estimated. Amortization schedules your mortgage payments and tracks what the money goes toward. Learn how amortization works in real estate for different loans.

Fid Emerging Mkts

Investment Objective. The fund aims to achieve capital growth over time. The fund invests at least 70% (and normally 75%). View the latest Fidelity Emerging Markets Fund (FEMKX) stock price, news, historical charts, analyst ratings and financial information from WSJ. The fund seeks to provide investment results that correspond to the total return of emerging stock markets. Strategy. Normally investing at least 80% of assets. Performance charts for Fidelity Emerging Markets Class Fund (FDEMMKCB) including intraday, historical and comparison charts, technical analysis and trend. Objective. Seeks capital appreciation. ; Strategy. Normally investing at least 80% of assets in securities of issuers in emerging markets and other investments. Overseas investments may be more volatile than established markets. The shares in the investment trust are listed on the London Stock Exchange and their price. The fund invests normally at least 80% of assets in securities of issuers in emerging markets and other investments that are tied economically to emerging. GQG Partners Emerging Markets Equity Fund Investor Shares. $ GQGPX %. Fidelity Index Fund. $ FXAIX %. This fund invests in emerging markets which can be more volatile than other more developed markets. This fund uses financial derivative instruments for. Investment Objective. The fund aims to achieve capital growth over time. The fund invests at least 70% (and normally 75%). View the latest Fidelity Emerging Markets Fund (FEMKX) stock price, news, historical charts, analyst ratings and financial information from WSJ. The fund seeks to provide investment results that correspond to the total return of emerging stock markets. Strategy. Normally investing at least 80% of assets. Performance charts for Fidelity Emerging Markets Class Fund (FDEMMKCB) including intraday, historical and comparison charts, technical analysis and trend. Objective. Seeks capital appreciation. ; Strategy. Normally investing at least 80% of assets in securities of issuers in emerging markets and other investments. Overseas investments may be more volatile than established markets. The shares in the investment trust are listed on the London Stock Exchange and their price. The fund invests normally at least 80% of assets in securities of issuers in emerging markets and other investments that are tied economically to emerging. GQG Partners Emerging Markets Equity Fund Investor Shares. $ GQGPX %. Fidelity Index Fund. $ FXAIX %. This fund invests in emerging markets which can be more volatile than other more developed markets. This fund uses financial derivative instruments for.

Objective. The investment seeks capital appreciation. The fund invests normally at least 80% of assets in securities of issuers in emerging markets and other. In he became an assistant portfolio manager and in he was appointed portfolio manager of an internal EMEA mandate. Before joining Fidelity, Nick. The investment seeks capital appreciation. The fund invests normally at least 80% of assets in securities of issuers in emerging markets and other investments. (KR), NVIDIA Corporation (US:NVDA), and PT Bank Central Asia Tbk - Depositary Receipt (Common Stock) (US:PBCRY). FEMKX - Fidelity Emerging Markets. Analyze the Fund Fidelity ® Emerging Markets Fund having Symbol FEMKX for type mutual-funds and perform research on other mutual funds. Learn more about. FEMKX - Fidelity Emerging Markets Fund - Review the FEMKX stock price, growth, performance, sustainability and more to help you make the best investments. The Fidelity Emerging Market Quality Income Index is designed to reflect the performance of large and mid-capitalization companies from emerging market. The investment seeks capital appreciation. The fund invests normally at least 80% of assets in securities of issuers in emerging markets and other. Fidelity Emerging Markets Idx overview and insights. Fidelity Emerging Markets Fund · NAV $ $ / %. Aug · Inception Dec · Benchmark MSCI Emerging Markets Index · Aggregate assets (all. Focus on investing in smaller capitalization companies exposed to secular growth trends of ascendant emerging market domestic economies. Normally investing at. The Fund seeks capital appreciation. Fidelity Management & Research normally invests in securities of issuers in emerging markets, by allocating investments. Fidelity Emerging Markets K Overview Fidelity Investments / Diversified Emerging Mkts. The fund invests normally at least 80% of assets in securities of issuers. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging. About FPADX. The investment seeks to provide investment results that correspond to the total return of emerging stock markets. The fund normally invests at. Fidelity Investments is a leading provider of investment management, retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other. The latest fund information for Fidelity Emerging Markets W Acc, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund. Complete Fidelity Emerging Markets Fund;K funds overview by Barron's. View the FKEMX funds market news. About Fidelity Emerging Markets Fund (FEMKX). There are 1 members of the management team with an average tenure of years: John Dance (). Management. See fund information and historical performance for the Spartan Emerging Markets Index Fund - Fidelity Advantage Institutional Class (FPADX).

0 Intro Purchase Apr Credit Card

Citi Rewards+® Credit Card 0% Intro APR for 15 months on purchases and balance transfers; after that, the variable APR will be % - %, based on your. Intro Balance Transfer APR is 0% for 15 months from date of first transfer, for transfers under this offer that post to your account by November 10, then. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. RBC Visa Classic Low Rate Option · Low interest rate on purchases and cash advances · Low annual fee · Purchase security and extended warranty insurance. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Citi Rewards+® Credit Card 0% Intro APR for 15 months on purchases and balance transfers; after that, the variable APR will be % - %, based on your. Intro Balance Transfer APR is 0% for 15 months from date of first transfer, for transfers under this offer that post to your account by November 10, then. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. RBC Visa Classic Low Rate Option · Low interest rate on purchases and cash advances · Low annual fee · Purchase security and extended warranty insurance. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply.

An introductory 0% APR credit card doesn't charge interest on purchases, balance transfers or both made during the promotional period. This can add flexibility. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June 0% interest rate—can mean losing the card's introductory APR, its grace period and paying surprise interest on new purchases. The grace period is the time. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After. 0% APR is temporary No matter how generous the introductory APR period on your new credit card may be, eventually it will end at some point. No 0% APR offer. A card with a 0% introductory APR lets you make purchases without incurring any finance charges during the promotional period, but these cards do still require. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. Balance transfer 0% introductory APR for first 18 billing cycles after account opening. After that, %, %, %, % or % variable APR based. 0% intro APR credit card offers from our partners ; FEATURES (1) · Cash Back ; CARD ISSUERS (0) · American Express ; CREDIT SCORE (0) · Excellent (). Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. 0% Introductory APR for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the intro APR offer ends, % - A 0% intro balance transfer APR credit card means that customers won't be charged interest on their qualifying balance transfers for a specified period of time. CIBC Select Visa Card The CIBC Select Visa card has a 0% intro APR of up to 10 months and a 1% transfer fee. The amount you can transfer is. Specifically, a 0% card won't charge you interest on purchases, balance transfers or both (depending on the offer) if you don't pay your. Citi Custom Cash® Card: Best Intro APR Card for Automatic Earning Maximization · Citi Rewards+® Card: Best Intro APR Card for Earning Citi ThankYou Points. An introductory 0% APR credit card doesn't charge interest on purchases, balance transfers or both made during the promotional period. This can add flexibility. 0% introductory APR on purchases for 15 months from account opening date. After that, a variable APR applies, currently % - %, based on your. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. 8 best 0% APR and low-interest credit cards of September ; Capital One VentureOne Rewards Credit Card · Capital One VentureOne Rewards Credit Card ; Blue.

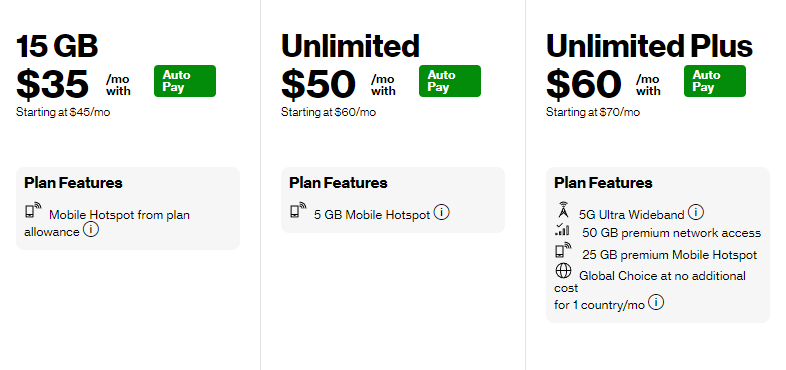

Verizon Post Paid Plans

Enjoy multiple ways to save with Verizon Prepaid. ; 15 GB. First month for $45/mo. $35 · 35 · Mobile Hotspot from plan allowance ; Unlimited. First month for $60/mo. 5G Home and LTE Home for $35/mo. w/ Auto Pay (where service is available). When combined with a postpaid mobile unlimited plan that includes 5G Ultra Wideband. Learn about standard monthly Verizon plans for your mobile phones and connected devices. Get details about managing your plan's features, discounts and perks. Bring your own device: Receive up to $ promo credit ($ on postpaid Unlimited Plus or $ on Unlimited Ultimate) when you add a new smartphone line with. Unlimited Welcome: $30/line/mo for 4 lines, less $20 account discount. Auto Pay and paper-free billing req'd. Unlimited 5G / 4G LTE: For Unlimited Welcome plan. Here's just a quick glimpse at Verizon's postpaid unlimited plans that range in price from $ per month: Unlimited Welcome: Unlimited talk, text, and data. 5G Home/LTE Home: Plans start at $35/mo. when combined with postpaid mobile unlimited plan that includes 5G Ultra Wideband. Fios Mbps: Plans start at $35/mo. Monthly smartphone fee after credit: $0. Limited time offer Smartphone purchase w/new line, device payment agmt & $ or higher price plan req'd. Verizon's postpaid plans all have unlimited data. For two lines you'll end up paying $$80 plus fees per line, depending on how much "Premium. Enjoy multiple ways to save with Verizon Prepaid. ; 15 GB. First month for $45/mo. $35 · 35 · Mobile Hotspot from plan allowance ; Unlimited. First month for $60/mo. 5G Home and LTE Home for $35/mo. w/ Auto Pay (where service is available). When combined with a postpaid mobile unlimited plan that includes 5G Ultra Wideband. Learn about standard monthly Verizon plans for your mobile phones and connected devices. Get details about managing your plan's features, discounts and perks. Bring your own device: Receive up to $ promo credit ($ on postpaid Unlimited Plus or $ on Unlimited Ultimate) when you add a new smartphone line with. Unlimited Welcome: $30/line/mo for 4 lines, less $20 account discount. Auto Pay and paper-free billing req'd. Unlimited 5G / 4G LTE: For Unlimited Welcome plan. Here's just a quick glimpse at Verizon's postpaid unlimited plans that range in price from $ per month: Unlimited Welcome: Unlimited talk, text, and data. 5G Home/LTE Home: Plans start at $35/mo. when combined with postpaid mobile unlimited plan that includes 5G Ultra Wideband. Fios Mbps: Plans start at $35/mo. Monthly smartphone fee after credit: $0. Limited time offer Smartphone purchase w/new line, device payment agmt & $ or higher price plan req'd. Verizon's postpaid plans all have unlimited data. For two lines you'll end up paying $$80 plus fees per line, depending on how much "Premium.

Pros: Postpaid and prepaid plans available. day free trial. Go5G Next: Qualifying new financed device & Go5G Next plan req'd. Upgrade qualifying device in good condition after 6+ months with 50% paid off; upgrade ends. Details: Bring your own device: Receive up to $ promo credit ($ on postpaid Unlimited Plus or $ on Unlimited Ultimate) when you add a new smartphone. Details: Bring your own device: Receive up to $ promo credit ($ on postpaid Unlimited Plus or $ on Unlimited Ultimate) when you add a new. Unlimited Welcome: $30/line/mo for 4 lines, less $20 account discount. Auto Pay and paper-free billing req'd. Unlimited 5G / 4G LTE: For Unlimited Welcome plan. The Verizon Unlimited Plus postpaid plan from Verizon is a strong choice and should work well for many consumers. It offers 5G Ultra Wideband coverage. Prepaid SIM Card (US Mobile) - Custom Plans from $4/mo. Unlimited. More Like This. iPhone: $ ( GB only) device payment or full retail purchase w/new or upgrade smartphone line on Unlimited Ultimate plan (min. $90/mo w/Auto Pay (+. Honestly, if you're looking to reduce, there's a good chance a prepaid plan would work better for you. $40/2GB, $50/5GB. But know that switching. You can save a fair chunk of change each month by switching from one of the Big Three—Verizon, T-Mobile, or AT&T—to a smaller cellular provider. Data after 6. Postpaid priority is only higher for mid-top tier plans. Yet Verizon prepaid has just the deprio for $50, and that drops down to $40 after 9. The Verizon Unlimited Plus postpaid plan from Verizon is a strong choice and should work well for many consumers. It offers 5G Ultra Wideband coverage. Visible offers unlimited data, talk and text for $25/month powered by Verizon. Check out our plans, deals, and devices today. network tower Network. Unlimited data, talk & text on Verizon's 5G & 4G LTE networks. ; hotspot icon Mobile Hotspot. Unlimited use of your phone as a WiFi. Verizon Postpaid 3-in-1 SIM Card, LTE, 3-in-1 (4FF / 3FF / 2FF) for Any Verizon Phone, Prepaid and Postpaid Compatible, No NFC Support · Other items based on. Plans available with a month-to-month or device payment agreement. Prices include $5 savings per month per line when you sign up for Auto Pay and paper-free. What is the difference in service for Verizon Wireless Phone prepaid plan as compared to post paid plan? Some benefits of postpaid. 5G Home and LTE Home for $35/mo. w/ Auto Pay (where service is available). When combined with a postpaid mobile unlimited plan that includes 5G Ultra Wideband. You can save $10–$20 a month by switching from a Verizon postpaid plan to a Verizon prepaid plan. Find the best Verizon prepaid plans here. Verizon SIM Card FITS ALL PHONES Triple Cut PRE/POST PAID Plans ; Quantity. sold. More than 10 available ; Item Number. ; Features. Unlimited.

1 2 3 4 5